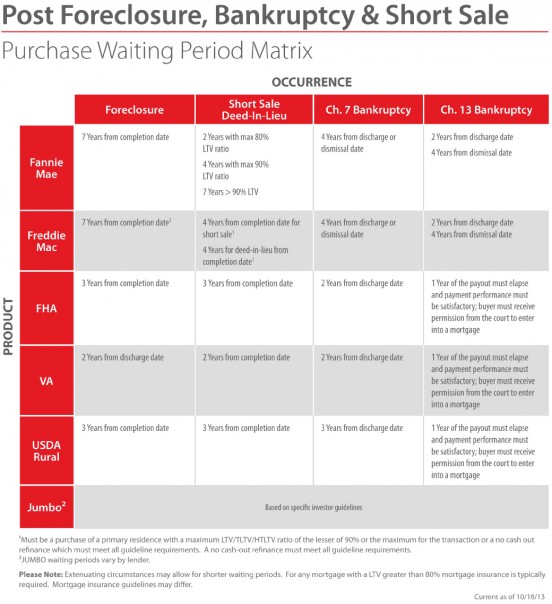

Over the last handful of years, many Orange County residents have had to give up their homes due to hard times. Short sales, foreclosures, and bankruptcies all have an impact on one’s credit score and could potentially affect one’s ability to buy a home down the road. So how long exactly do you have to wait until your credit is high enough to purchase the OC home of your dreams? As always, real estate agent Cheryl Marquis is here with your answers…

| Chapter 7 Bankruptcy | Chapter 13 Bankruptcy | |||

| Fannie Mae | 4 years (Chapter 7 or 11) | Fannie Mae | 2 years from discharge date | |

| Freddie Mac | 4 years from dismissal (Chapter 7 or 11) | 4 years from dismissal date | ||

| FHA | 2 years from discharge date | Freddie Mac | 2 years from discharge date | |

| VA | 2 years from discharge date | 4 years from dismissal date | ||

| USDA Rural | 3 years from discharge date | FHA & VA | 1 year of the payout must elapse and payment performance must be satisfactory. Buyer must receive permission from the court to enter into mortgage | |

| USDA Rural | 3 years from discharge date | |||

| Deed-In-Lieu of Foreclosure | Foreclosure | |||

| Freddie Mac | 4 years from completion date | Freddie Mae | 7 years – after a prior foreclosure to be eligible for a new mortgage eligible for sale to Fannie Mae, unless the foreclosure was the result of documented extenuating circumstances, which only requires a 3 year waiting period (with additional requirements) | |

| Fannie Mae | 2 years – 80% max LTV ratios | Freddie Mac | 7 years from completion date | |

| 4 years – 90% max LTV ratios | FHA | 7 years from completion date | ||

| Greater LTV’s can require up to 7 years | VA | 2 years from completion date | ||

| USDA Rural | 3 years from completion date | |||

| Short Sale | |

| Fannie Mae | 2 years – 80% max LTV ratios |

| 4 years – 90% max LTV ratios | |

| Greater LTV’s can require up to 7 years | |

| Freddie Mac | 4 years from completion date |

| FHA | 4 years from completion date |

| If the borrower was current at the time of the short sale and all mortgage installment payments were made within in a month due, you may qualify for an exception removing the waiting period. | |

| VA | No specific information available, assume foreclosure rule of 2 years |

| USDA Rural | No specific information available, assume foreclosure rule of 3 years |