What’s up with mortgage rates? Jeff Lazerson of Mortgage Grader in Laguna Niguel gives us his take.

RATE NEWS SUMMARY

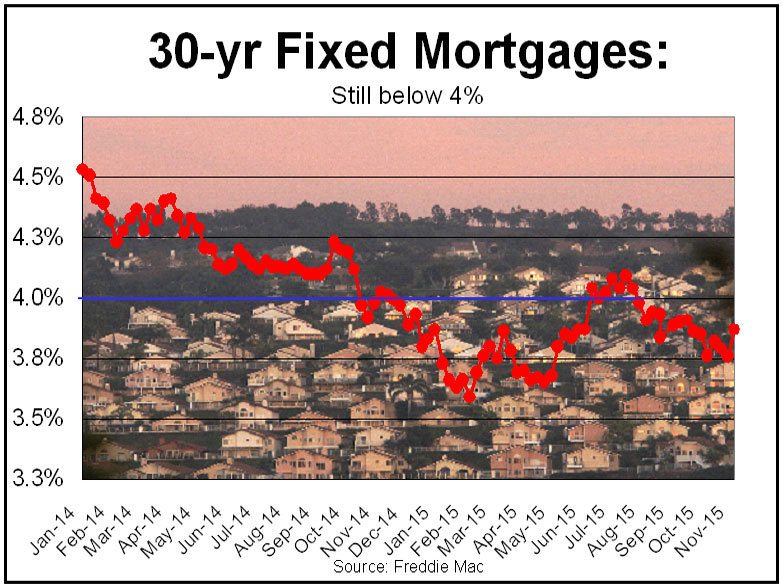

From Freddie Mac’s weekly survey: The 30-year fixed jumped 11 basis points, rising to 3.87 percent from last week’s 3.76 percent. Ditto for the 15-year fixed, cracking the 3 percent mark, landing at 3.09 percent, 11 basis points higher than last week’s 2.98 percent.

BOTTOM LINE: Assuming a borrower gets the average 30-year conforming fixed rate on a $417,000 loan, last year’s rate of 3.98 percent and payment of $1,986 is just $26 more than this week’s payment of $1,960.

The Mortgage Bankers Association reports just under a 1 percent decrease in loan application volume from the previous week.

WHAT I SEE: From rate sheets hitting my desk that are not part of Freddie Mac’s survey: Locally, for loan balances up to $1 million you can get the following loans for 1 point:

- A 5/1 adjustable rate mortgage, or ARM, (fixed for five years and adjustable annually each year after that) at 2.875 percent;

- A 7/1 ARM at 3.375 percent;

- A 15- or 30-year fixed at 3.875 percent;

- And a 30-year fixed that has an interest only feature for the first ten years and then amortizes for the remaining 20 years.

Original article found on The OC Register.com

Written by: By Jeff Lazerson

Photo: Freddie Mac

* this post is NOT in sponsorship with OC Register, Jeff Lazerson or Freddie Mac